The “R” Word

Our clients wonder what a recession would mean for the real estate market.

Many assume it would translate into a downturn in prices.

Some even worry that it would cause values to come crashing down.

We looked back in history, at past recessions, to gain an understanding of what recessions mean for the Front Range market.

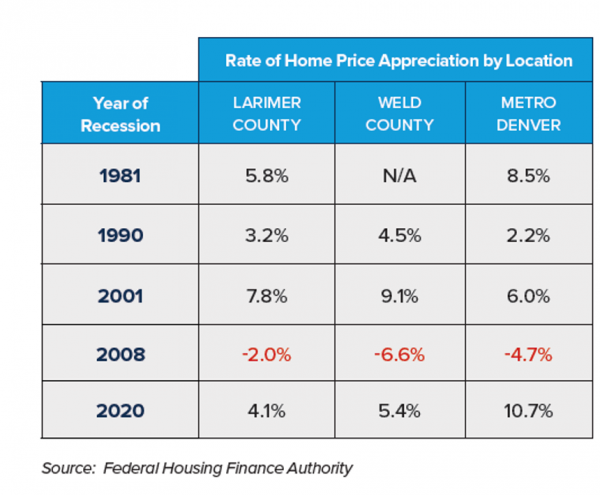

We used the extensive data from the Federal Housing Finance Authority to look at home price appreciation during the five recessions dating back to 1981.

What we found was quite interesting.

During the five recessions of 1981, 1990, 2001, 2008 and 2020, home prices along the Front Range went up in all but the 2008 recession.

What was unique about 2008 was that housing led the recession. Whereas the other recessions were triggered by some combination of inflation, oil prices, and stock market issues (plus the pandemic in 2020).

So, if the past is an indicator of the future, a recession is not guaranteed to result in lower real estate prices.

The Front Range real estate market has always demonstrated long-term health and a great resiliency to outside economic events.

See the chart below for the detailed research…

The post The “R” Word appeared first on Fort Collins Real Estate | Fort Collins Homes for Sale & Property Search.