Renting vs Buying: Which is better for you?

Deciding whether to rent or buy can be a difficult decision, but with the right analysis, you can determine which is best for you. Knowing whether it’s the right time to rent or buy depends on your buying power, what you’re looking for in a home, your local market conditions, your plans for you and your household, and the responsibilities you’re prepared to take on at your residence.

Renting vs. Buying: Which is Better for You?

Renting gives you greater flexibility to relocate, fewer home maintenance responsibilities, and can often be more the more affordable option, depending on where you live. The extra costs associated with owning a home—interest payments, taxes, repairs—may be too much for some renters to handle. Becoming a homeowner has its respective advantages. You’ll have stable monthly payments and greater freedom to customize your living space. Advocates of buying will contend that purchasing a home is an investment in equity, which can increase in value every year you live in the home, whereas if you rent a property, you’re essentially paying for someone else’s mortgage.

Ultimately, the right decision depends on your situation. If you don’t plan to be living in the same place for at least five years, renting might be more logical, as it allows you more flexibility when it comes time to move again. If you’re looking to settle down for the better part of a decade or longer and can afford to buy a home, becoming a homeowner may be the better option. Here are a few additional considerations to guide your renting-versus-buying decision making process.

What are the local real estate market conditions?

Investigate the local sales and rental markets. Industry groups put out reports every quarter stating the average national sales price for a home and the average monthly payment for a rental. These reports are typically based on an average of all the cities in the U.S. But what really matters is what the numbers show when you dig into them on a local level. When looking at these reports, you’ll see there are some cities that fall below that average, while others rise above it. When comparing housing costs, be sure to base your evaluation on what’s happening in your city and neighborhood, not the nationwide averages.

For a quarterly breakdown of local market conditions, explore our Market Updates page. With data analyzed by our Chief Economist Matthew Gardner, each report breaks down the latest figures in home sales, home prices, and days on market for regions throughout Windermere’s footprint. Gardner also provides his estimation of where each market sits on the buyer’s-market-to-seller’s-market spectrum.

What can you afford?

Making the jump from renter to homeowner is often a question of affordability. Your mortgage rate will depend on your financial strength, your credit score, and other factors, so make sure to talk to a loan officer before you start looking for a home. Getting pre-approved for a mortgage will identify what you’re able to afford and helps strengthen your offer when the time comes.

To get an idea of what you can afford, use our free Home Monthly Payment Calculator by clicking the button below. With current rates based on national averages and customizable mortgage terms, you can experiment with different values to get an estimate of your monthly payment for any listing price. By using the Home Monthly Payment Calculator, you can make a well-informed estimation of whether it’s the right time to buy.

Will you need to make repairs to your new home?

Buying a fixer-upper may seem like a great way to get a deal on a house, but if the money you spend on the repairs is too great, your profit could be diminished when it comes time to sell. The same is true for remodeling and improvement projects. There are various renovation financing loans available to you that can help with the costs of home repairs, though extra consultations, inspections, and appraisals are often required in the process of securing these loans. Ultimately, if you can only afford a home that demands major improvements, and you don’t have the skills to do much of the work yourself, you may be better off renting.

Can you rent part of the house you’re buying?

If you buy a house with rental-capable space (extra bedroom, mother-in-law unit, etc.), you could use the rental income to pay off your mortgage faster and contribute more to your savings. But, of course, you need to be willing to share your home with a tenant and take on the responsibilities of being a landlord or working with a professional property manager to help you with those duties. Renting out a space in your home will also require you to purchase landlord insurance on top of your existing homeowners insurance policy.

Making Your Decision to Rent or Buy

At the end of the day, the decision is up to you. Based on the conditions laid out above, it simply may not be the right time for you to buy. Fortunately, when it comes to being a homeowner, it’s not now or never. A real estate agent will be your ultimate resource in gauging whether it’s the right time to buy and guiding you through the process toward homeownership.

The post Renting vs Buying: Which is better for you? appeared first on Fort Collins Real Estate | Fort Collins Homes for Sale & Property Search.

-year to an average of $523,193. Prices were up 7.4% compared to the second quarter of this year.

-year to an average of $523,193. Prices were up 7.4% compared to the second quarter of this year.

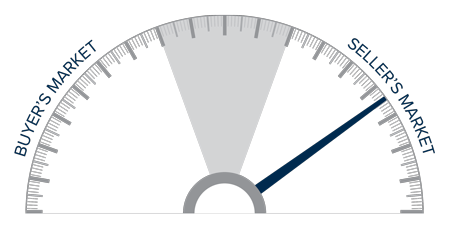

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.