Larimer Resilience

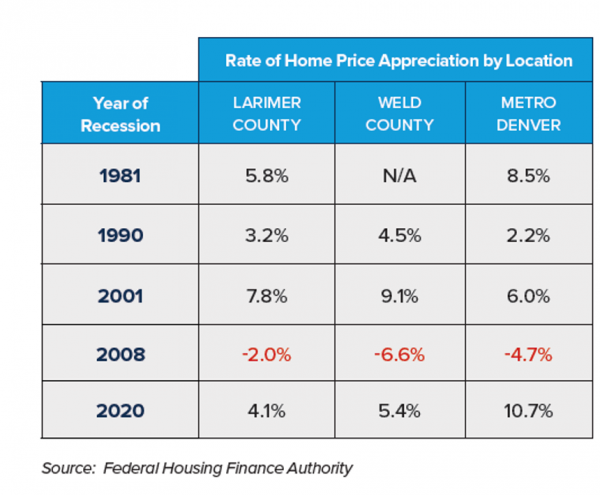

To see the resilience of the Front Range market, look no further than Larimer County.

The average price for closed single-family homes in the month of July was $724,000.

This is only the third time in history Larimer County has exceeded $700,000 for average price in a month.

July’s average price is a whopping 12% higher than February’s average price which was $646,000.

A 12% difference in just a few months is significant in any market.

What makes this increase especially significant is that interest rates have been above 6.5% the entire time.

Higher rates did not keep prices from going higher.

The post Larimer Resilience appeared first on Fort Collins Real Estate | Fort Collins Homes for Sale & Property Search.