Q3 2021 Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The rise in COVID-19 infections due to the Delta variant caused Colorado’s job recovery to slow, but not as much as in many other states. The latest data (for August) shows that more than 293,000 of the 376,000+ jobs that were shed due to COVID-19 have returned. This is good news, with only 83,000 jobs needed to return to pre-pandemic employment levels. The metro areas contained in this report have recovered 243,700 of the 310,000 jobs lost, and I expect the state will recover the remaining jobs by next summer. With employment levels improving, the state unemployment rate currently stands at 5.9%—down from the pandemic peak of 12.1%. Regionally, unemployment levels range from a low of 4.4% in Boulder to a high of 6.1% in Grand Junction.

__________

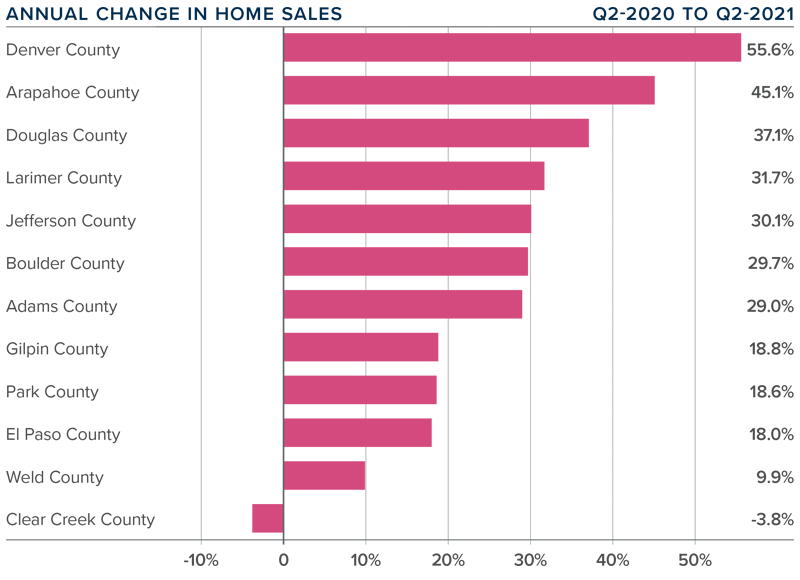

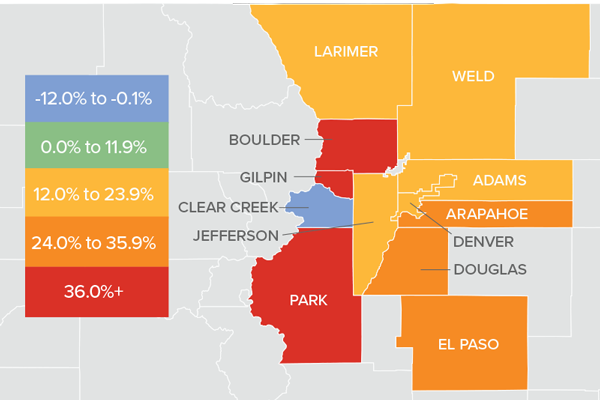

Colorado Home Sales

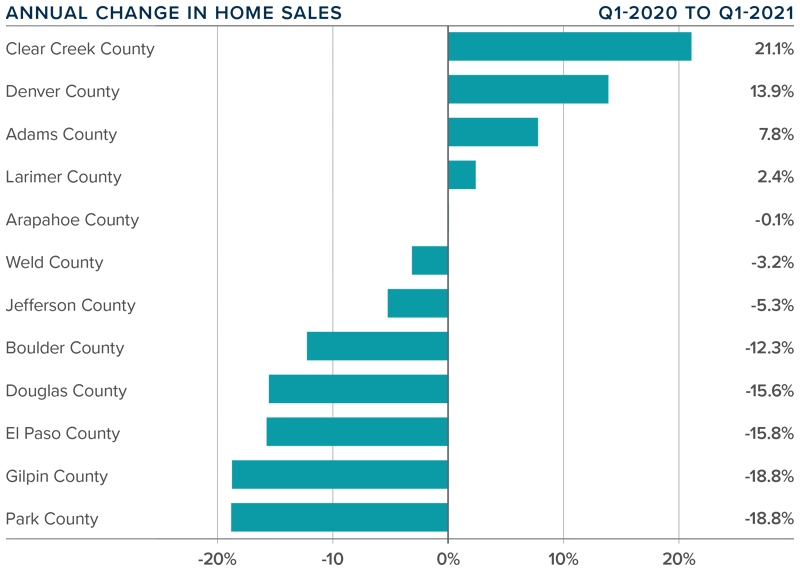

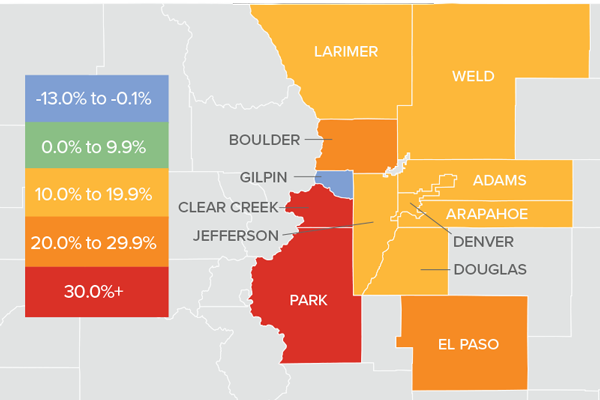

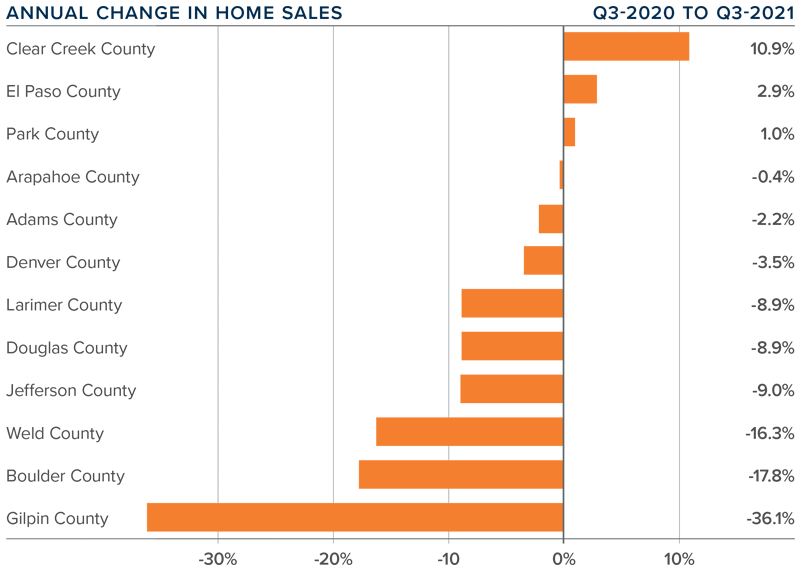

❱ Compared to a year ago, listing activity was down more than 30%. However, inventory levels were up 38.3% compared to the second quarter of this year, suggesting that buyers have more choice now than they have seen in some time.

❱ Although comparing current sales activity with that of a year ago is not that informative—given that the country was experiencing a massive rebound in housing demand following the outbreak of COVID-19—it was pleasing to see sales up in every county other than Denver and Douglas compared to the second quarter of this year.

❱ Pending sales (an indicator of future closings) were down 5.4% compared to the second quarter of the year, suggesting that closings in the final quarter may well be a little soft.

__________

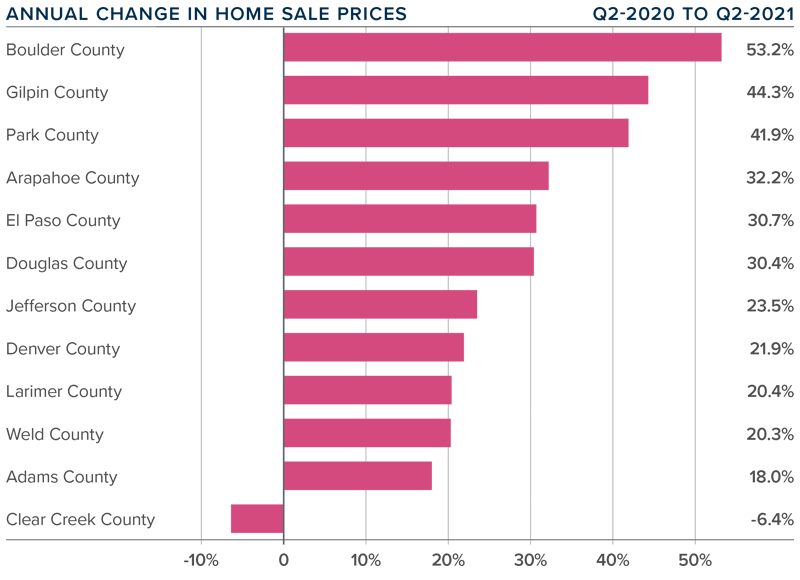

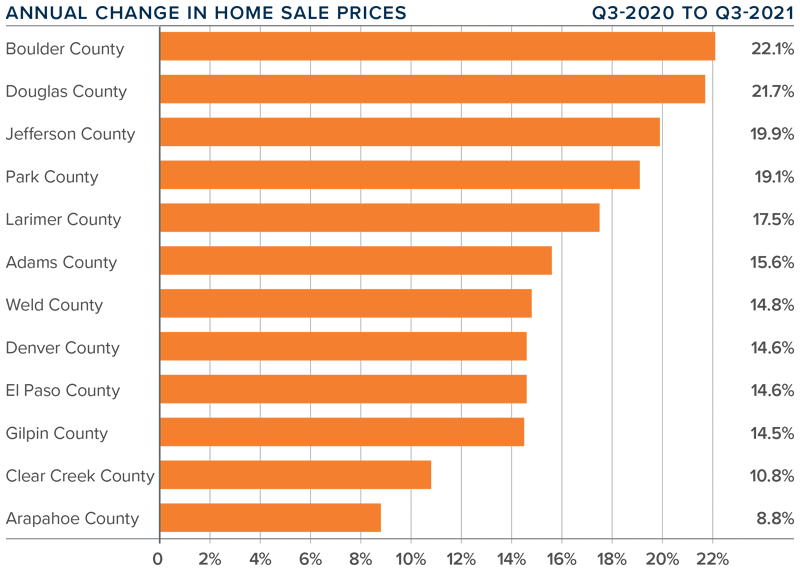

Colorado Home Prices

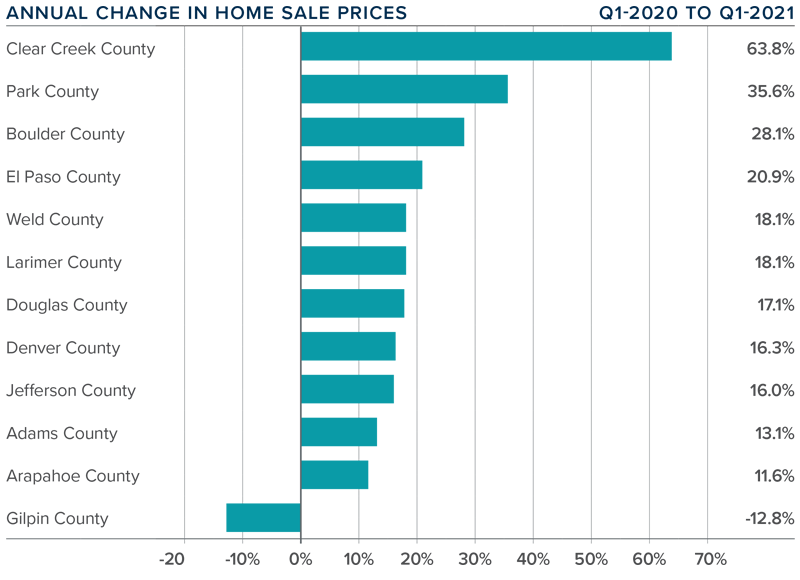

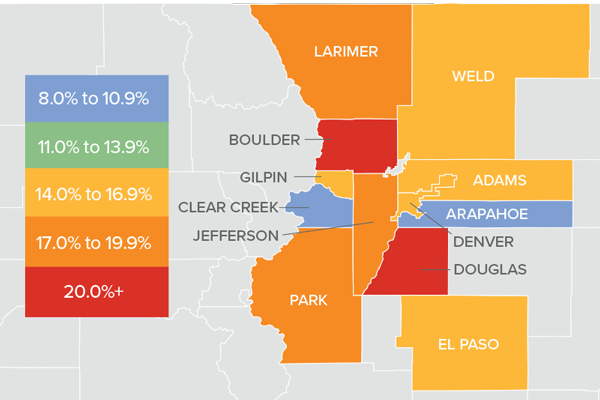

❱ Prices continue to appreciate at a very rapid pace, with the average sale price up 15.8% year over year to an average of $605,576. Sale prices were 1.6% lower than in the second quarter of 2021.

❱ Four counties—Arapahoe, Douglas, Weld, and Park—saw the average home sale price pull back between the second quarter and the third, but I am not overly concerned by this at the present time.

❱ Year-over-year, prices rose across all markets covered by this report. All counties except Arapahoe saw double-digit gains, but even that market saw an increase in sale prices.

❱ Several counties are experiencing a drop in average list prices, which is a leading indicator of future activity. As such, I expect to see the rise of sale prices start to slow, which will be a welcome sight for many buyers.

__________

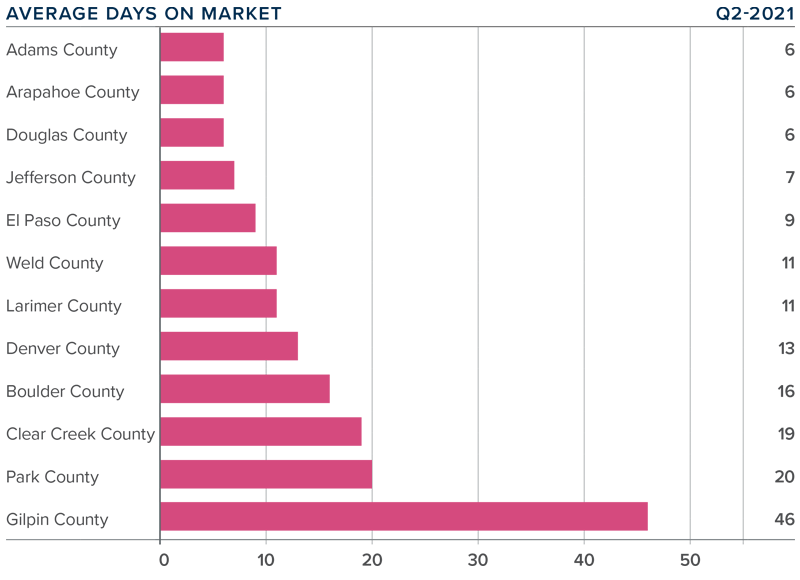

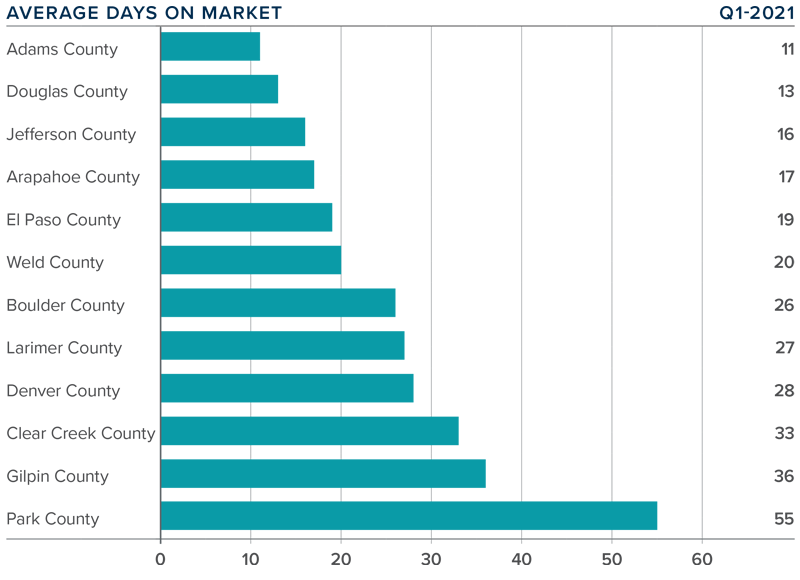

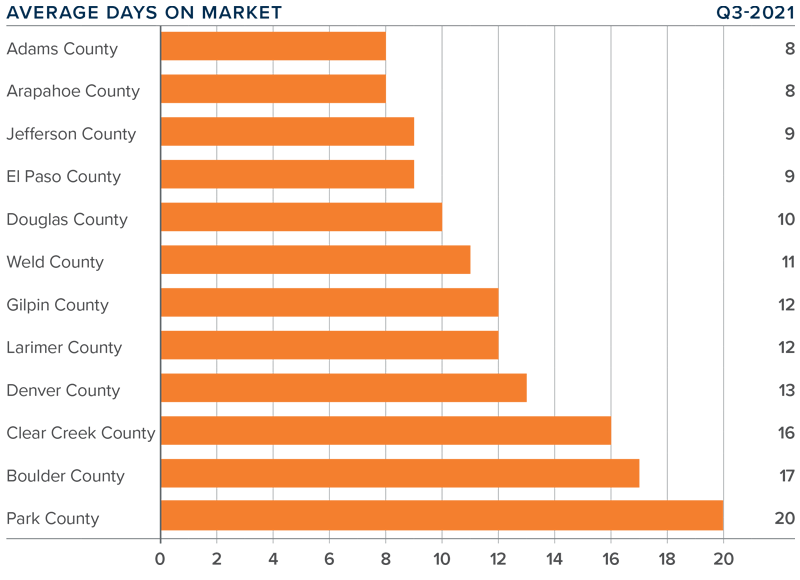

Days on Market

❱ The average number of days it took to sell a home in the markets contained in this report dropped 17 days compared to the third quarter of 2020.

❱ The length of time it took to sell a home dropped in every county contained in this report compared to both the same quarter a year ago and the second quarter of this year.

❱ It took an average of only 12 days to sell a home in the region, which is down 2 days compared to the second quarter of 2021.

❱ The Colorado housing market remains very tight as demonstrated by the fact that it took less than three weeks for homes to sell in all counties contained in this report.

Conclusions

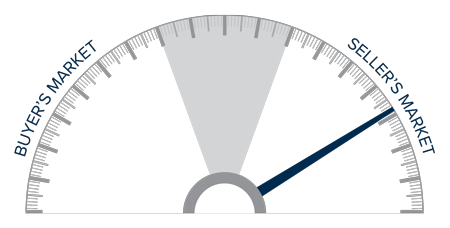

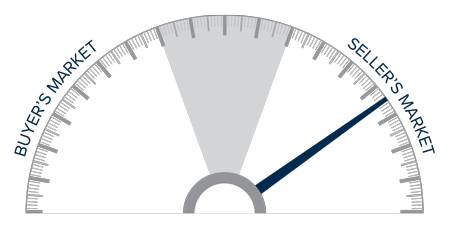

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The job market continues to improve, which is always a stimulant when it comes to home buying. Inventory levels have improved, and lower pending sales suggest that buyers are taking a little longer to decide on a home. That said, the market is still bullish as indicated by the short length of time it took to sell a home in the quarter. Mortgage rates will start to creep higher as we move into the winter months, and this may stimulate additional buying activity. In the last edition of The Gardner Report, I suggested we would see more homes come to market and that has proven to be accurate. Given these factors, I am moving the needle a little toward buyers, but it remains a staunchly seller’s market.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

The post Q3 2021 Colorado Real Estate Market Update appeared first on Fort Collins Real Estate | Fort Collins Homes for Sale & Property Search.