Yes is the Answer

It turns out that ‘yes’ is the answer to the most common questions we hear right now about the market…

Do you think more properties will come on the market this Spring? Yes, the normal pattern in our market is for new listings to be 40% to 70% higher in April versus January. The peak month for new listings is typically June.

Do you think buyer demand will grow even more as time goes on? Yes, for two main reasons. Buyer activity, just like listing activity, increases significantly in the Spring and Summer. Plus, we expect the economy to open up even more as the COVID vaccine gets rolled out over the course of the year.

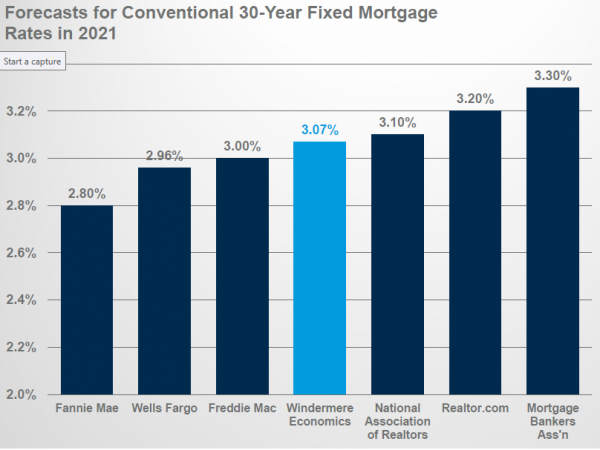

Do you think interest rates will go up? Yes, all of the trusted forecasters and economists expect rates to be slightly higher by the end of the year. Our own Chief Economist sees rates at 3.07% by year-end.

Do you think prices will keep rising? Yes, because of the simple economic forces of supply and demand. Supply is at historic lows. The number of properties for sale today is roughly 80% below the average. Demand is being fueled not only by the low-interest rates, but also a rebounding local job market that is poised to rebound even more. Plus, the new work-from-home dynamic positions the Front Range as a sought after place to live.

The post Yes is the Answer appeared first on Fort Collins Real Estate | Fort Collins Homes for Sale & Property Search.